124

Z Platform: The Place to Be for Entrepreneurs and Business Growth

46

imgpost/124/logopost.jpg

Advertising/Communication

Views :

246

Date add :

12/26/2025

Z Platform: The Place to Be for Entrepreneurs and Business Growth The Z Platform is officially open — and ready for anyone who believes in entrepreneurship, innovation, and sustainable business growth.Built to support small and medium-sized businesses, independent professionals, creators, and entrepreneurs, Z Platform was designed with one clear mission: to make o...

Z Platform: The Place to Be for Entrepreneurs and Business Growth

The Z Platform is officially open — and ready for anyone who believes in entrepreneurship, innovation, and sustainable business growth.Built to support small and medium-sized businesses, independent professionals, creators, and entrepreneurs, Z Platform was designed with one clear mission: to make o...

|

123

How You Can Make Money with Zbynet

19

imgpost/123/logopost.jpg

Business Opportunities

Views :

723

Date add :

12/11/2025

How You Can Make Money with Zbynet — Starting with Just $179/YearThe digital world is changing — and with it, the way people connect, communicate, do business, and earn rewards online.Zbynet was created for people like you.People who want to be present, connected, rewarded, and part of something that grows together.And the best part?...

How You Can Make Money with Zbynet

— Starting with Just $179/YearThe digital world is changing — and with it, the way people connect, communicate, do business, and earn rewards online.Zbynet was created for people like you.People who want to be present, connected, rewarded, and part of something that grows together.And the best part?...

|

122

Why Now Is the Best Time to Secure Your Spot on the Z Business Directory

46

imgpost/122/logopost.jpg

Advertising/Communication

Views :

987

Date add :

11/21/2025

Why Now Is the Best Time to Secure Your Spot on the Z Business Directory The online world is changing fast — and right now, a major shift is happening inside the Zbynet ecosystem. The Z Business Directory is growing at an incredible pace, and for small and medium-size business owners, this moment represents a unique opportunity to secure long-term visibility, credibility...

Why Now Is the Best Time to Secure Your Spot on the Z Business Directory

The online world is changing fast — and right now, a major shift is happening inside the Zbynet ecosystem. The Z Business Directory is growing at an incredible pace, and for small and medium-size business owners, this moment represents a unique opportunity to secure long-term visibility, credibility...

|

121

Immigrants in America: A Changing Promise, A Shared Future

12

imgpost/121/logopost.jpg

Community / Religion

Views :

947

Date add :

11/15/2025

Immigrants in America: A Changing Promise, A Shared Future Why this conversation matters now — and why we need your voiceFor generations, the United States has been a beacon for immigrants searching for safety, work, and a place to build their future. The moment of naturalization — raising a hand and taking an oath — has long symbolized a powerful, mutual c...

Immigrants in America: A Changing Promise, A Shared Future

Why this conversation matters now — and why we need your voiceFor generations, the United States has been a beacon for immigrants searching for safety, work, and a place to build their future. The moment of naturalization — raising a hand and taking an oath — has long symbolized a powerful, mutual c...

|

120

The Advancements in AI Technology and Why You Should Join Zbynet Platform Today

19

imgpost/120/logopost.jpg

Business Opportunities

Views :

1510

Date add :

11/01/2025

The Advancements in AI Technology and Why You Should Join Zbynet Platform Today Artificial Intelligence (AI) has revolutionized the way we live, work, and connect. Every day, new advancements in AI technology are transforming industries—from how we communicate with clients to how we manage businesses online. Small and medium-sized businesses now have access to tools once reserv...

The Advancements in AI Technology and Why You Should Join Zbynet Platform Today

Artificial Intelligence (AI) has revolutionized the way we live, work, and connect. Every day, new advancements in AI technology are transforming industries—from how we communicate with clients to how we manage businesses online. Small and medium-sized businesses now have access to tools once reserv...

|

119

The Best Reasons to List and Create Your Page on Z Platform

19

imgpost/119/logopost.jpg

Business Opportunities

Views :

1637

Date add :

10/22/2025

The Best Reasons to List and Create Your Page on Z Platform In today's digital world, visibility and connection are everything. That's why creating your business page on Z Platform is one of the smartest moves you can make for your company.1. Be Seen by the Right PeopleZ Platform is a growing network built for entrepreneurs, professionals, and local business...

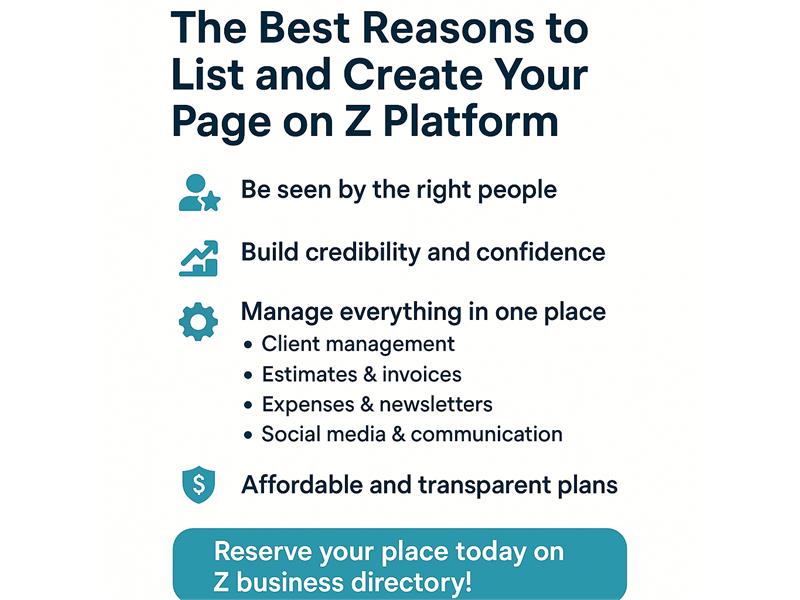

The Best Reasons to List and Create Your Page on Z Platform

In today's digital world, visibility and connection are everything. That's why creating your business page on Z Platform is one of the smartest moves you can make for your company.1. Be Seen by the Right PeopleZ Platform is a growing network built for entrepreneurs, professionals, and local business...

|

118

The Problem: The End of the Millionaire-Liquidity Era?

11

imgpost/118/logopost.jpg

Banks/Financial Services

Views :

1680

Date add :

10/18/2025

The Problem: The End of the Millionaire-Liquidity Era? Growing risks & structural headwindsThe U.S. economy is facing a confluence of forces that are undermining what I'll call the “millionaire-liquidity” environment — that is, the era in which large private wealth, easy credit, high asset valuations, consumption driven by affluent households, and optim...

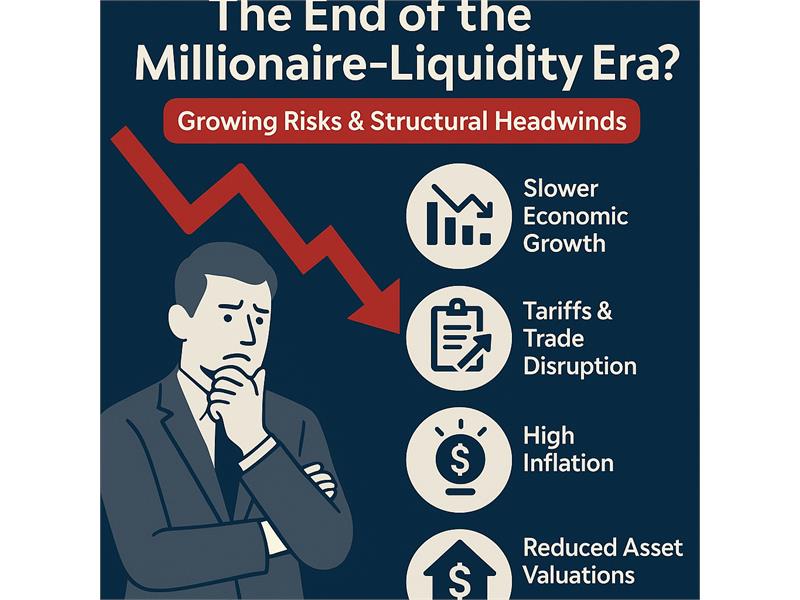

The Problem: The End of the Millionaire-Liquidity Era?

Growing risks & structural headwindsThe U.S. economy is facing a confluence of forces that are undermining what I'll call the “millionaire-liquidity” environment — that is, the era in which large private wealth, easy credit, high asset valuations, consumption driven by affluent households, and optim...

|

117

Together for Humanity: Reaffirming President Lula's Call at the UN

12

imgpost/117/logopost.jpg

Community / Religion

Views :

2846

Date add :

09/25/2025

Together for Humanity: Reaffirming President Lula's Call at the UN When President Luiz Inácio Lula da Silva addressed the United Nations, he did more than deliver a political speech—he issued a wake-up call to humanity. His pronouncement was not simply a reflection on the problems of our time, but a moral appeal for unity, responsibility, and action. In a world inc...

Together for Humanity: Reaffirming President Lula's Call at the UN

When President Luiz Inácio Lula da Silva addressed the United Nations, he did more than deliver a political speech—he issued a wake-up call to humanity. His pronouncement was not simply a reflection on the problems of our time, but a moral appeal for unity, responsibility, and action. In a world inc...

|

116

Estamos Estarrecidos: O Voto de Fux e os Riscos à Lógica Jurídica no Brasil

4

imgpost/116/logopost.jpg

Legal/Law Services

Views :

4875

Date add :

09/11/2025

Estamos Estarrecidos: O Voto de Fux e os Riscos à Lógica Jurídica no Brasil A sociedade brasileira acompanha com perplexidade o voto proferido pelo ministro Luiz Fux no julgamento dos acusados de atentarem contra a ordem democrática. Não se trata apenas de divergência jurídica: o que se observa é uma condução que abre caminhos perigosos e sem volta para a lógica do Direito,...

Estamos Estarrecidos: O Voto de Fux e os Riscos à Lógica Jurídica no Brasil

A sociedade brasileira acompanha com perplexidade o voto proferido pelo ministro Luiz Fux no julgamento dos acusados de atentarem contra a ordem democrática. Não se trata apenas de divergência jurídica: o que se observa é uma condução que abre caminhos perigosos e sem volta para a lógica do Direito,...

|

115

A Teoria do Desdobramento do Tempo

9

imgpost/115/logopost.jpg

Media/Books/Publishing

Views :

12018

Date add :

08/16/2025

A Teoria do Desdobramento do Tempo de Jean-Pierre Garnier MaletVivemos em uma era em que ciência, espiritualidade e filosofia buscam pontos de encontro para explicar nossa experiência no mundo. Entre as teorias que mais chamam a atenção nesse cenário está a Teoria do Desdobramento do Tempo, proposta pelo físico francês Jean-Pierre G...

A Teoria do Desdobramento do Tempo

de Jean-Pierre Garnier MaletVivemos em uma era em que ciência, espiritualidade e filosofia buscam pontos de encontro para explicar nossa experiência no mundo. Entre as teorias que mais chamam a atenção nesse cenário está a Teoria do Desdobramento do Tempo, proposta pelo físico francês Jean-Pierre G...

|

114

Um Chamado para Construir o Futuro Juntos

12

imgpost/114/logopost.jpg

Community / Religion

Views :

11712

Date add :

08/13/2025

Um Chamado para Construir o Futuro Juntos Além de Nós: Vivemos tempos em que grande parte da vida acontece na internet. O acesso à informação é imenso, mas também são imensos os riscos e as distrações. Já entendemos como esse mundo digital funciona — e sabemos que, quando mal utilizado, não acrescenta nada real.Não precisamos nos vender ou ...

Um Chamado para Construir o Futuro Juntos

Além de Nós: Vivemos tempos em que grande parte da vida acontece na internet. O acesso à informação é imenso, mas também são imensos os riscos e as distrações. Já entendemos como esse mundo digital funciona — e sabemos que, quando mal utilizado, não acrescenta nada real.Não precisamos nos vender ou ...

|

113

Roteiro de Alinhamento Energético Pessoal

13

imgpost/113/logopost.jpg

Health/Medical/Pharmacy

Views :

7980

Date add :

06/19/2025

Roteiro de Alinhamento Energético Pessoal ROTEIRO DE ALINHAMENTO ENERGÉTICO PESSOAL (para tempos de transição)Ideal para ser feito diariamente ou 3x por semana, em qualquer fase da vida, especialmente quando estiver sentindo cansaço inexplicável, confusão mental, sensibilidade emocional ou sintomas de desdobramento.1- Enraizamento (Groundin...

Roteiro de Alinhamento Energético Pessoal

ROTEIRO DE ALINHAMENTO ENERGÉTICO PESSOAL (para tempos de transição)Ideal para ser feito diariamente ou 3x por semana, em qualquer fase da vida, especialmente quando estiver sentindo cansaço inexplicável, confusão mental, sensibilidade emocional ou sintomas de desdobramento.1- Enraizamento (Groundin...

|

112

Your Investment Works for You

46

imgpost/112/logopost.jpg

Advertising/Communication

Views :

13493

Date add :

05/28/2025

Your Investment Works for You Why Listing Your Business on Zbynet with a Subscription is the Smartest Move You Can MakeWhen you choose to subscribe and add your business to the Zbynet Platform, you're not just gaining access to powerful online tools — you're becoming part of a growing network built to support small and mid-sized...

Your Investment Works for You

Why Listing Your Business on Zbynet with a Subscription is the Smartest Move You Can MakeWhen you choose to subscribe and add your business to the Zbynet Platform, you're not just gaining access to powerful online tools — you're becoming part of a growing network built to support small and mid-sized...

|

111

Why Your Small Business Needs a Website

19

imgpost/111/logopost.jpg

Business Opportunities

Views :

12831

Date add :

05/24/2025

Why Your Small Business Needs a Website Why Every Small Business Needs a Website—and Why You Should Connect It to Zbynet.comIn today's digital era, having a professional online presence is not optional—it's essential. Whether you're a local service provider, a freelance professional, or a growing startup, your business must be visible whe...

Why Your Small Business Needs a Website

Why Every Small Business Needs a Website—and Why You Should Connect It to Zbynet.comIn today's digital era, having a professional online presence is not optional—it's essential. Whether you're a local service provider, a freelance professional, or a growing startup, your business must be visible whe...

|

110

Zbynet Platform Seeks Angel Investors and Entrepreneurs

19

imgpost/110/logopost.jpg

Business Opportunities

Views :

12385

Date add :

04/16/2025

Zbynet Platform Seeks Angel Investors and Entrepreneurs to Scale Up and Share the Profits – The Time is Now!Zbynet Platform is on the rise — and we're calling on visionary angel investors and driven entrepreneurs to join us at a pivotal moment. Our mission is bold yet simple: to empower businesses of all sizes with powerful tools to manage, grow, and mo...

Zbynet Platform Seeks Angel Investors and Entrepreneurs

to Scale Up and Share the Profits – The Time is Now!Zbynet Platform is on the rise — and we're calling on visionary angel investors and driven entrepreneurs to join us at a pivotal moment. Our mission is bold yet simple: to empower businesses of all sizes with powerful tools to manage, grow, and mo...

|

109

Fim da Reeleição Parlamentar e Restrições à Candidatura de Parentes

12

imgpost/109/logopost.jpg

Community / Religion

Views :

8924

Date add :

04/15/2025

Fim da Reeleição Parlamentar e Restrições à Candidatura de Parentes A Urgente Necessidade de Reforma na Legislação

Brasileira: A democracia brasileira, embora consolidada sob diversos

aspectos, ainda carrega sérios vícios que minam a renovação política, comprometem a ética no exercício do poder e perpetuam a influência de oligarquias familiares nas estruturas do Est...

Fim da Reeleição Parlamentar e Restrições à Candidatura de Parentes

A Urgente Necessidade de Reforma na Legislação

Brasileira: A democracia brasileira, embora consolidada sob diversos

aspectos, ainda carrega sérios vícios que minam a renovação política, comprometem a ética no exercício do poder e perpetuam a influência de oligarquias familiares nas estruturas do Est...

|

108

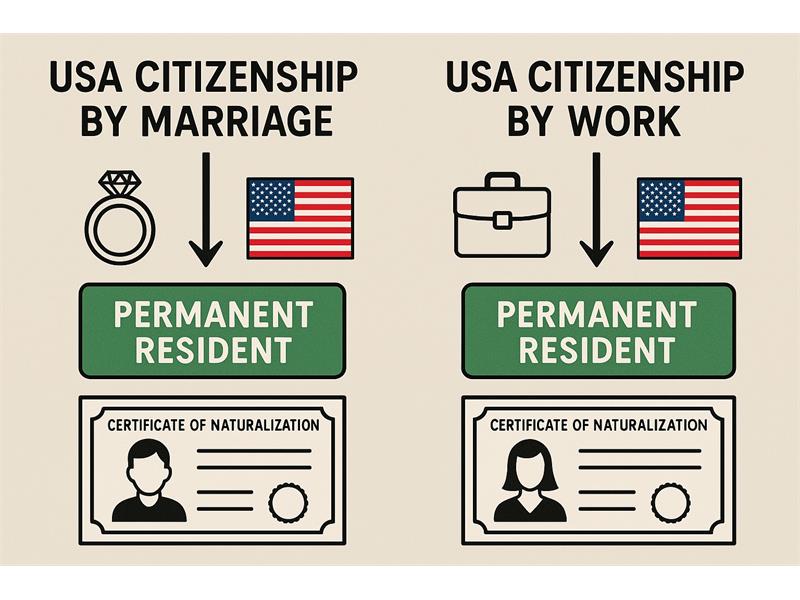

Differences between obtaining U S citizenship through marriage and through work

4

imgpost/108/logopost.jpg

Legal/Law Services

Views :

10005

Date add :

04/10/2025

Differences between obtaining U S citizenship through marriage and through work Any differences between obtaining U Scitizenship through marriage and through work?Yes, there are several important differences betweenobtaining U.S. citizenship through marriage and through work, primarily inthe path to getting a green card (permanent residency) and eventuallyapplying for naturaliz...

Differences between obtaining U S citizenship through marriage and through work

Any differences between obtaining U Scitizenship through marriage and through work?Yes, there are several important differences betweenobtaining U.S. citizenship through marriage and through work, primarily inthe path to getting a green card (permanent residency) and eventuallyapplying for naturaliz...

|

107

How Trump's Tariffs Could Shake the Economy - and the Real Estate Market

48

imgpost/107/logopost.jpg

Real Estate Services

Views :

10137

Date add :

04/08/2025

How Trump's Tariffs Could Shake the Economy - and the Real Estate Market How Trump's Tariffs Could Shake the Economy—and the RealEstate MarketAs the U.S. enters another phase of economic nationalismunder former President Donald Trump's proposed second-term agenda, tariffs areonce again at the forefront of his economic strategy. Trump has floated ideasfor broad tariffs of...

How Trump's Tariffs Could Shake the Economy - and the Real Estate Market

How Trump's Tariffs Could Shake the Economy—and the RealEstate MarketAs the U.S. enters another phase of economic nationalismunder former President Donald Trump's proposed second-term agenda, tariffs areonce again at the forefront of his economic strategy. Trump has floated ideasfor broad tariffs of...

|

106

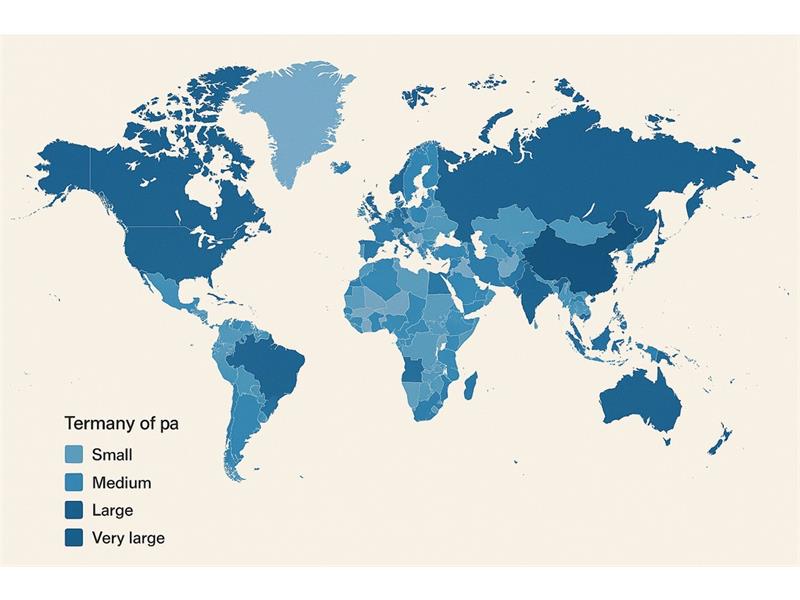

Os maiores países em território (em termos de área)

35

imgpost/106/logopost.jpg

Travel Agency

Views :

8720

Date add :

04/03/2025

Os maiores países em território (em termos de área) Os maiores países em território (em termos de área) são:Rússia - 17,1 milhões de km²A Rússia é de longe o maior país do mundo, abrangendo uma vasta extensão da Europa e da Ásia, com diversos tipos de clima e paisagens.Canadá - 9,98 milhões de km²O Canadá é o segundo maior país, localizado na América...

Os maiores países em território (em termos de área)

Os maiores países em território (em termos de área) são:Rússia - 17,1 milhões de km²A Rússia é de longe o maior país do mundo, abrangendo uma vasta extensão da Europa e da Ásia, com diversos tipos de clima e paisagens.Canadá - 9,98 milhões de km²O Canadá é o segundo maior país, localizado na América...

|

104

O Alcorão sobre o Universo em Expansão e a Teoria do Bing Bang

12

imgpost/104/logopost.jpg

Community / Religion

Views :

7870

Date add :

03/21/2025

O Alcorão sobre o Universo em Expansão e a Teoria do Bing Bang Lei de HubblePor milhares de anos astrônomosdisputaram contra questões básicas relacionadas ao universo.Até o início dosanos 20 acreditava-se que o universo sempre tinha existido e também que otamanho do universo era fixo e não se alterava.Entretanto, em 1912 oastrônomo americano Vesto Slipher fez u...

O Alcorão sobre o Universo em Expansão e a Teoria do Bing Bang

Lei de HubblePor milhares de anos astrônomosdisputaram contra questões básicas relacionadas ao universo.Até o início dosanos 20 acreditava-se que o universo sempre tinha existido e também que otamanho do universo era fixo e não se alterava.Entretanto, em 1912 oastrônomo americano Vesto Slipher fez u...

|

105

Unlock the Power of Zbynet Platform: Maximize Your Business Potential for Just $179/year

46

imgpost/105/logopost.jpg

Advertising/Communication

Views :

7647

Date add :

03/21/2025

Unlock the Power of Zbynet Platform: Maximize Your Business Potential for Just $179/year In today's digital world, the ability to stand out and grow your business online is crucial for success. With so many options available to businesses, it can be overwhelming to know where to invest your time and resources. That's where the Zbynet Platform comes in, offering a unique solution that co...

Unlock the Power of Zbynet Platform: Maximize Your Business Potential for Just $179/year

In today's digital world, the ability to stand out and grow your business online is crucial for success. With so many options available to businesses, it can be overwhelming to know where to invest your time and resources. That's where the Zbynet Platform comes in, offering a unique solution that co...

|

103

The way to advertize your business are changing with AI

46

imgpost/103/logopost.jpg

Advertising/Communication

Views :

9336

Date add :

03/14/2025

The way to advertize your business are changing with AI How Small Businesses Can Build an Effective Online Presence with AI-Driven SolutionsIn today's fast-paced digital world, the way we advertise and market businesses is undergoing a profound shift, especially with the rise of Artificial Intelligence (AI). Gone are the days when businesses needed to sp...

The way to advertize your business are changing with AI

How Small Businesses Can Build an Effective Online Presence with AI-Driven SolutionsIn today's fast-paced digital world, the way we advertise and market businesses is undergoing a profound shift, especially with the rise of Artificial Intelligence (AI). Gone are the days when businesses needed to sp...

|

102

10 Tips for you be prepared for taxes in 2025

41

imgpost/102/logopost.jpg

Accounting/Tax Service

Views :

9823

Date add :

03/13/2025

10 Tips for you be prepared for taxes in 2025 10 Best Tips to Be Prepared for Taxes in 2025Tax season can be stressful, especially when you're scrambling at the last minute to get everything in order. But with a little preparation and organization, you can make the process much easier and more manageable. As we look ahead to 2025, here are ten ...

10 Tips for you be prepared for taxes in 2025

10 Best Tips to Be Prepared for Taxes in 2025Tax season can be stressful, especially when you're scrambling at the last minute to get everything in order. But with a little preparation and organization, you can make the process much easier and more manageable. As we look ahead to 2025, here are ten ...

|

100

2025: The Year Founders Build Better, Not Bigger

19

imgpost/100/logopost.jpg

Business Opportunities

Views :

8186

Date add :

01/02/2025

2025: The Year Founders Build Better, Not Bigger 2024 wasn't a walk in the park. It tested us, shaped us, andreminded us that survival isn't guaranteed-but resilience pays off. As we stepinto 2025, the startup world is evolving faster than ever.This year, the rules are different. It's not about whoscales fastest-it's about who scales smartest. Thi...

2025: The Year Founders Build Better, Not Bigger

2024 wasn't a walk in the park. It tested us, shaped us, andreminded us that survival isn't guaranteed-but resilience pays off. As we stepinto 2025, the startup world is evolving faster than ever.This year, the rules are different. It's not about whoscales fastest-it's about who scales smartest. Thi...

|

101

Unlock the Future of Online Advertising with Zbynet in 2025

46

imgpost/101/logopost.jpg

Advertising/Communication

Views :

10250

Date add :

01/02/2025

Unlock the Future of Online Advertising with Zbynet in 2025 In today's rapidly evolving digital landscape, business owners and professionals face increasing challenges to stand out, attract customers, and build trust online. In 2025, the need for reliable, innovative platforms to showcase products and services has never been greater. Enter Zbynet, the platfo...

Unlock the Future of Online Advertising with Zbynet in 2025

In today's rapidly evolving digital landscape, business owners and professionals face increasing challenges to stand out, attract customers, and build trust online. In 2025, the need for reliable, innovative platforms to showcase products and services has never been greater. Enter Zbynet, the platfo...

|

99

Aprenda a Fazer Cocô Corretamente e Seja Feliz!

13

imgpost/99/logopost.jpg

Health/Medical/Pharmacy

Views :

8779

Date add :

12/21/2024

Aprenda a Fazer Cocô Corretamente e Seja Feliz! Aprendaa Fazer Cocô Corretamente e Seja Feliz!Bem-vindoao guia que transformará a sua rotina! Este eBook é dedicado a ensinar aspráticas corretas para ir ao vaso, garantindo saúde intestinal, prevenindodoenças e promovendo bem-estar.Por queeste tema é importante?Muitaspessoas enfrentam dificuldades ...

Aprenda a Fazer Cocô Corretamente e Seja Feliz!

Aprendaa Fazer Cocô Corretamente e Seja Feliz!Bem-vindoao guia que transformará a sua rotina! Este eBook é dedicado a ensinar aspráticas corretas para ir ao vaso, garantindo saúde intestinal, prevenindodoenças e promovendo bem-estar.Por queeste tema é importante?Muitaspessoas enfrentam dificuldades ...

|

96

The 10 best ways to make money online today

11

imgpost/96/logopost.jpg

Banks/Financial Services

Views :

10722

Date add :

10/16/2024

The 10 best ways to make money online today Here are ten popular ways to make money online:Freelancing: Offer your skills in writing, graphic design, programming, or marketing on platforms like Upwork or Fiverr.Online Tutoring: Teach subjects you're knowledgeable about through websites like VIPKid, Tutor.com, or Chegg Tutors.Affiliate Marketi...

The 10 best ways to make money online today

Here are ten popular ways to make money online:Freelancing: Offer your skills in writing, graphic design, programming, or marketing on platforms like Upwork or Fiverr.Online Tutoring: Teach subjects you're knowledgeable about through websites like VIPKid, Tutor.com, or Chegg Tutors.Affiliate Marketi...

|

97

How to Make Money on Pinterest in 2024

19

imgpost/97/logopost.jpg

Business Opportunities

Views :

13675

Date add :

10/16/2024

How to Make Money on Pinterest in 2024 Can You Make Money on Pinterest Today?Although the app's popularity has waned over the years, it has never

been easier to make money on Pinterest. Happily, you can make money on

the platform, either full-time or part-time. Plus, you can do so without a website or blog. In fact, pinning on Pinterest ...

How to Make Money on Pinterest in 2024

Can You Make Money on Pinterest Today?Although the app's popularity has waned over the years, it has never

been easier to make money on Pinterest. Happily, you can make money on

the platform, either full-time or part-time. Plus, you can do so without a website or blog. In fact, pinning on Pinterest ...

|

98

Why the extraterrestrial contact with races from another planet is happening first on the spiritual community

12

imgpost/98/logopost.jpg

Community / Religion

Views :

14527

Date add :

10/16/2024

Why the extraterrestrial contact with races from another planet is happening first on the spiritual community Extraterrestrial contact with races from other planets often resonates strongly within the spiritual community for several reasons:Openness to New Ideas: The spiritual community tends to embrace concepts beyond conventional understanding, including metaphysical ideas, consciousness expansion, and th...

Why the extraterrestrial contact with races from another planet is happening first on the spiritual community

Extraterrestrial contact with races from other planets often resonates strongly within the spiritual community for several reasons:Openness to New Ideas: The spiritual community tends to embrace concepts beyond conventional understanding, including metaphysical ideas, consciousness expansion, and th...

|

95

Alfabetização Digital O caminho seguro para a nossa evolução

26

imgpost/95/logopost.jpg

Coaching/Training

Views :

9136

Date add :

10/06/2024

Alfabetização Digital O caminho seguro para a nossa evolução O problema é que qualquer um ze mane sem qualificação na area, esta virando guru e usando ferramentas erradas, perigosas e programadas para fins escusos. Dai eles ganham dinheiro como influencers ensinando o que não sabem com a ajuda dos chats gpt. O problema são as ferramentas ou do usuário que sem...

Alfabetização Digital O caminho seguro para a nossa evolução

O problema é que qualquer um ze mane sem qualificação na area, esta virando guru e usando ferramentas erradas, perigosas e programadas para fins escusos. Dai eles ganham dinheiro como influencers ensinando o que não sabem com a ajuda dos chats gpt. O problema são as ferramentas ou do usuário que sem...

|

94

Why is important list your business on Zbynet today

19

imgpost/94/logopost.jpg

Business Opportunities

Views :

12246

Date add :

07/10/2024

Why is important list your business on Zbynet today Listing your business on Zbynet today can be beneficial for several reasons:Increased Visibility: Zbynet is emerging as a prominent business directory, which means listing your business there can significantly enhance its visibility. This increased exposure can attract more potential customers or cl...

Why is important list your business on Zbynet today

Listing your business on Zbynet today can be beneficial for several reasons:Increased Visibility: Zbynet is emerging as a prominent business directory, which means listing your business there can significantly enhance its visibility. This increased exposure can attract more potential customers or cl...

|

93

Why are more and more older people spending their dying years behind bars?

12

imgpost/93/logopost.jpg

Community / Religion

Views :

13323

Date add :

05/13/2024

Why are more and more older people spending their dying years behind bars? Americas prison system is turninginto a de facto nursing homeWhy are more and more older people spending their dying years behindbars?In late 2018, Richard Washington senta memo to the US Court of Appeals for the Ninth Circuit with the subjectline "Notice I am being killed." The 64-year-old man, who...

Why are more and more older people spending their dying years behind bars?

Americas prison system is turninginto a de facto nursing homeWhy are more and more older people spending their dying years behindbars?In late 2018, Richard Washington senta memo to the US Court of Appeals for the Ninth Circuit with the subjectline "Notice I am being killed." The 64-year-old man, who...

|

92

The 10 new and best ai websites doing all kinds of products

17

imgpost/92/logopost.jpg

Computer/Internet Services

Views :

14818

Date add :

05/10/2024

The 10 new and best ai websites doing all kinds of products Here are some of the best AI websites that you might find interesting:ChatGPT : A versatile chatbot with a wide range of conversational abilities. It's easy to implement and scales well. While it's not specialized in specific industries, it offers text-based interaction and API access for customizat...

The 10 new and best ai websites doing all kinds of products

Here are some of the best AI websites that you might find interesting:ChatGPT : A versatile chatbot with a wide range of conversational abilities. It's easy to implement and scales well. While it's not specialized in specific industries, it offers text-based interaction and API access for customizat...

|

90

Coaching plays a crucial role in today's business landscape, especially during these technological times

26

imgpost/90/logopost.jpg

Coaching/Training

Views :

13183

Date add :

05/08/2024

Coaching plays a crucial role in today's business landscape, especially during these technological times Coaching plays a crucial role in today's business landscape, especially during these technological times. Let's explore why coaching is essential and how it can benefit your business:The Importance of Coaching in Business1. Adapting to Technological ChangesDigital Transformation: As businesses under...

Coaching plays a crucial role in today's business landscape, especially during these technological times

Coaching plays a crucial role in today's business landscape, especially during these technological times. Let's explore why coaching is essential and how it can benefit your business:The Importance of Coaching in Business1. Adapting to Technological ChangesDigital Transformation: As businesses under...

|

91

The importance of online advertising for businesses and explore how the Zbynet Platform can be beneficial in achieving better results at lower costs

46

imgpost/91/logopost.jpg

Advertising/Communication

Views :

12427

Date add :

05/08/2024

The importance of online advertising for businesses and explore how the Zbynet Platform can be beneficial in achieving better results at lower costs Let's delve into the importance of online advertising for businesses and explore how the Zbynet Platform can be beneficial in achieving better results at lower costs.The Importance of Online Advertising for Businesses1. Wide Audience CoverageOnline advertising allows businesses to reach a global aud...

The importance of online advertising for businesses and explore how the Zbynet Platform can be beneficial in achieving better results at lower costs

Let's delve into the importance of online advertising for businesses and explore how the Zbynet Platform can be beneficial in achieving better results at lower costs.The Importance of Online Advertising for Businesses1. Wide Audience CoverageOnline advertising allows businesses to reach a global aud...

|

88

Sonho Americano: Viver e Trabalhar nos EUA - As 10 Verdades por Trás

19

imgpost/88/logopost.jpg

Business Opportunities

Views :

9394

Date add :

05/06/2024

Sonho Americano: Viver e Trabalhar nos EUA - As 10 Verdades por Trás O "Sonho Americano" é uma expressão que ressoa não apenas nos ouvidos dos cidadãos dos Estados Unidos, mas em corações e mentes ao redor do

mundo. Ele evoca imagens de oportunidade, liberdade e a promessa de uma

vida melhor, independentemente da origem de uma pessoa. Mas como

exatamente essa ideia s...

Sonho Americano: Viver e Trabalhar nos EUA - As 10 Verdades por Trás

O "Sonho Americano" é uma expressão que ressoa não apenas nos ouvidos dos cidadãos dos Estados Unidos, mas em corações e mentes ao redor do

mundo. Ele evoca imagens de oportunidade, liberdade e a promessa de uma

vida melhor, independentemente da origem de uma pessoa. Mas como

exatamente essa ideia s...

|

89

Here are ten safe and secure travel destinations you might consider for your next trip

35

imgpost/89/logopost.jpg

Travel Agency

Views :

12334

Date add :

05/06/2024

Here are ten safe and secure travel destinations you might consider for your next trip Safety is a top priority when planning a vacation. Here are ten safe and secure travel destinations you might consider for your next trip, along with some explanations:Canada: Canada tops the list as the safest country to travel to in 2024. It has low rates of violent crime and strict gun laws. Howe...

Here are ten safe and secure travel destinations you might consider for your next trip

Safety is a top priority when planning a vacation. Here are ten safe and secure travel destinations you might consider for your next trip, along with some explanations:Canada: Canada tops the list as the safest country to travel to in 2024. It has low rates of violent crime and strict gun laws. Howe...

|

87

50 Free Websites to List Your Business and Services

46

imgpost/87/logopost.jpg

Advertising/Communication

Views :

22084

Date add :

04/03/2024

50 Free Websites to List Your Business and Services Every business, regardless of its size, should prioritize being prominently featured on listing websites. In the current digital age, it's essential to ensure your company's name, contact details, and services are available on numerous listing websites. Major platforms like Yelp and Google Business ...

50 Free Websites to List Your Business and Services

Every business, regardless of its size, should prioritize being prominently featured on listing websites. In the current digital age, it's essential to ensure your company's name, contact details, and services are available on numerous listing websites. Major platforms like Yelp and Google Business ...

|

85

Avanços no Tratamento da Dengue: Esperança em Meio à Adversidade

13

imgpost/85/logopost.jpg

Health/Medical/Pharmacy

Views :

10154

Date add :

03/14/2024

Avanços no Tratamento da Dengue: Esperança em Meio à Adversidade ****A dengue, uma doença transmitida por mosquitos, é um problema de saúde global que afeta milhões de pessoas a cada ano. Com seus sintomas debilitantes e, em casos graves, potencialmente fatais, a busca por tratamentos eficazes tem sido uma prioridade para a comunidade médica e científica. Felizme...

Avanços no Tratamento da Dengue: Esperança em Meio à Adversidade

****A dengue, uma doença transmitida por mosquitos, é um problema de saúde global que afeta milhões de pessoas a cada ano. Com seus sintomas debilitantes e, em casos graves, potencialmente fatais, a busca por tratamentos eficazes tem sido uma prioridade para a comunidade médica e científica. Felizme...

|

86

What to do to became an artist on these days?

1

imgpost/86/logopost.jpg

Arts & Entertainment

Views :

15169

Date add :

03/14/2024

What to do to became an artist on these days? Becoming an artist in today's world can be an exciting and fulfilling journey, but it also requires dedication, passion, and adaptability. Here are some steps you can take to pursue a career as an artist:1. **Discover Your Passion**: Explore different art forms such as painting, drawing, sculpture, ...

What to do to became an artist on these days?

Becoming an artist in today's world can be an exciting and fulfilling journey, but it also requires dedication, passion, and adaptability. Here are some steps you can take to pursue a career as an artist:1. **Discover Your Passion**: Explore different art forms such as painting, drawing, sculpture, ...

|

82

Some information and facts about taxes in 2024

41

imgpost/82/logopost.jpg

Accounting/Tax Service

Views :

14713

Date add :

03/05/2024

Some information and facts about taxes in 2024 . Here are some points you may want to consider: .The federal income tax brackets and rates for 2024 have been adjusted for inflation. There are seven tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The top marginal rate of 37% applies to single filers with incomes above $609,350 and married coupl...

Some information and facts about taxes in 2024

. Here are some points you may want to consider: .The federal income tax brackets and rates for 2024 have been adjusted for inflation. There are seven tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The top marginal rate of 37% applies to single filers with incomes above $609,350 and married coupl...

|

83

Joe Biden and Donald Trump, the two candidates would likely present starkly different platform

12

imgpost/83/logopost.jpg

Community / Religion

Views :

15005

Date add :

03/05/2024

Joe Biden and Donald Trump, the two candidates would likely present starkly different platform In the hypothetical scenario of a 2024 presidential election rematch between s and visions for America's future. Let's delve into each candidate's platform to understand their respective approaches to key issues facing the nation.**Joe Biden's Platform:**President Joe Biden, seeking re-election, wou...

Joe Biden and Donald Trump, the two candidates would likely present starkly different platform

In the hypothetical scenario of a 2024 presidential election rematch between s and visions for America's future. Let's delve into each candidate's platform to understand their respective approaches to key issues facing the nation.**Joe Biden's Platform:**President Joe Biden, seeking re-election, wou...

|

84

What can be done to improve and expand animal-related services

29

imgpost/84/logopost.jpg

Animal Related Services

Views :

14412

Date add :

03/05/2024

What can be done to improve and expand animal-related services Animal-related services encompass a broad range of activities and initiatives aimed at promoting the welfare, health, and protection of animals. From pet care and adoption services to wildlife conservation and animal rescue operations, these services play a crucial role in ensuring the well-being of...

What can be done to improve and expand animal-related services

Animal-related services encompass a broad range of activities and initiatives aimed at promoting the welfare, health, and protection of animals. From pet care and adoption services to wildlife conservation and animal rescue operations, these services play a crucial role in ensuring the well-being of...

|

81

Why monitoring your business is crucial

46

imgpost/81/logopost.jpg

Advertising/Communication

Views :

16840

Date add :

12/04/2023

Why monitoring your business is crucial Media monitoring is crucial for businesses in today's dynamic and interconnected world. It involves systematically tracking, analyzing, and interpreting content from various media sources such as news, social media, and online platforms. The importance of media monitoring for your business can be en...

Why monitoring your business is crucial

Media monitoring is crucial for businesses in today's dynamic and interconnected world. It involves systematically tracking, analyzing, and interpreting content from various media sources such as news, social media, and online platforms. The importance of media monitoring for your business can be en...

|

79

Com a nova turma, o Google for Startups chegou a 66 startups

19

imgpost/79/logopost.jpg

Business Opportunities

Views :

20821

Date add :

11/28/2023

Com a nova turma, o Google for Startups chegou a 66 startups lideradas por empreendedores negros apoiadas pelo Black Founders Fund.Outro passo da empresa foi fazer parcerias para o CEP digital ser aceito por

serviços de saúde, de educação e bancário. A prefeitura de Ferraz de

Vasconcelos (SP) já aceita o número para mães e pais poderem cadastrar

crianças na ...

Com a nova turma, o Google for Startups chegou a 66 startups

lideradas por empreendedores negros apoiadas pelo Black Founders Fund.Outro passo da empresa foi fazer parcerias para o CEP digital ser aceito por

serviços de saúde, de educação e bancário. A prefeitura de Ferraz de

Vasconcelos (SP) já aceita o número para mães e pais poderem cadastrar

crianças na ...

|

80

Entenda a diferença entre os Arcturianos e os Mestres Ascensionados

12

imgpost/80/logopost.jpg

Community / Religion

Views :

15632

Date add :

11/28/2023

Entenda a diferença entre os Arcturianos e os Mestres Ascensionados Esta matéria serve para aqueles que ainda são leigos, mas que buscam ajuda e conhecimento. Os Arcturianos são como mestres ascensionados, mas não têm autorização para ajudar, a não ser que você lhes dê permissão para isso. Os Arcturianos ensinam que o ingrediente fundamental para viver na quinta dim...

Entenda a diferença entre os Arcturianos e os Mestres Ascensionados

Esta matéria serve para aqueles que ainda são leigos, mas que buscam ajuda e conhecimento. Os Arcturianos são como mestres ascensionados, mas não têm autorização para ajudar, a não ser que você lhes dê permissão para isso. Os Arcturianos ensinam que o ingrediente fundamental para viver na quinta dim...

|

78

Donald Trump will look to upstage Clemson grad Nikki Haley at her alma maters football rivalry game

12

imgpost/78/logopost.jpg

Community / Religion

Views :

16217

Date add :

11/25/2023

Donald Trump will look to upstage Clemson grad Nikki Haley at her alma maters football rivalry game Donald Trump will look to upstage Clemson grad Nikki Haley at her alma mater's football rivalry gameCOLUMBIA, S.C. (AP) - Donald Trump is using a college football rivalry weekend to bask among his

supporters in a state and region that are key to his presidential

fortunes, while potentially upstaging...

Donald Trump will look to upstage Clemson grad Nikki Haley at her alma maters football rivalry game

Donald Trump will look to upstage Clemson grad Nikki Haley at her alma mater's football rivalry gameCOLUMBIA, S.C. (AP) - Donald Trump is using a college football rivalry weekend to bask among his

supporters in a state and region that are key to his presidential

fortunes, while potentially upstaging...

|

77

Tarcísio promete entregar linhas de metrô que ainda não têm projeto em SP

22

imgpost/77/logopost.jpg

Construction & Contractors

Views :

16654

Date add :

10/23/2023

Tarcísio promete entregar linhas de metrô que ainda não têm projeto em SP Do UOLPressa no calendário. O governador Tarcísio de Freitas (Republicanos) prometeu ao menos dez obras de trem e metrô para São Paulo. Em três delas, o projeto está pronto. Em uma, o projeto ainda está sendo produzindo, e em outra ele foi contratado. Cinco linhas ainda estão em fase de estudos, um ...

Tarcísio promete entregar linhas de metrô que ainda não têm projeto em SP

Do UOLPressa no calendário. O governador Tarcísio de Freitas (Republicanos) prometeu ao menos dez obras de trem e metrô para São Paulo. Em três delas, o projeto está pronto. Em uma, o projeto ainda está sendo produzindo, e em outra ele foi contratado. Cinco linhas ainda estão em fase de estudos, um ...

|

76

Como IA revive a teoria da internet morta

12

imgpost/76/logopost.jpg

Community / Religion

Views :

19035

Date add :

08/10/2023

Como IA revive a teoria da internet morta Há algunsanos, surgiu uma teoria da conspiração chamada "Dead Internettheory", afirmando que não existiria mais conteúdo e interações humanas nainternet e que quase a totalidade do tráfego darede teria origem em sistemas de IA e bots para manipular a opinião pública e modular ocomportamento dos usuá...

Como IA revive a teoria da internet morta

Há algunsanos, surgiu uma teoria da conspiração chamada "Dead Internettheory", afirmando que não existiria mais conteúdo e interações humanas nainternet e que quase a totalidade do tráfego darede teria origem em sistemas de IA e bots para manipular a opinião pública e modular ocomportamento dos usuá...

|

75

Construction services

22

imgpost/75/logopost.jpg

Construction & Contractors

Views :

20596

Date add :

06/21/2023

Construction services cover a wide range of tasks and responsibilities throughout the building process. From design to completion, there is a plethora of services and parameters that should be taken care of. Some of the services that fall under construction services include:Design and planningSite preparationBuilding co...

Construction services

cover a wide range of tasks and responsibilities throughout the building process. From design to completion, there is a plethora of services and parameters that should be taken care of. Some of the services that fall under construction services include:Design and planningSite preparationBuilding co...

|